Irs payroll withholding calculator

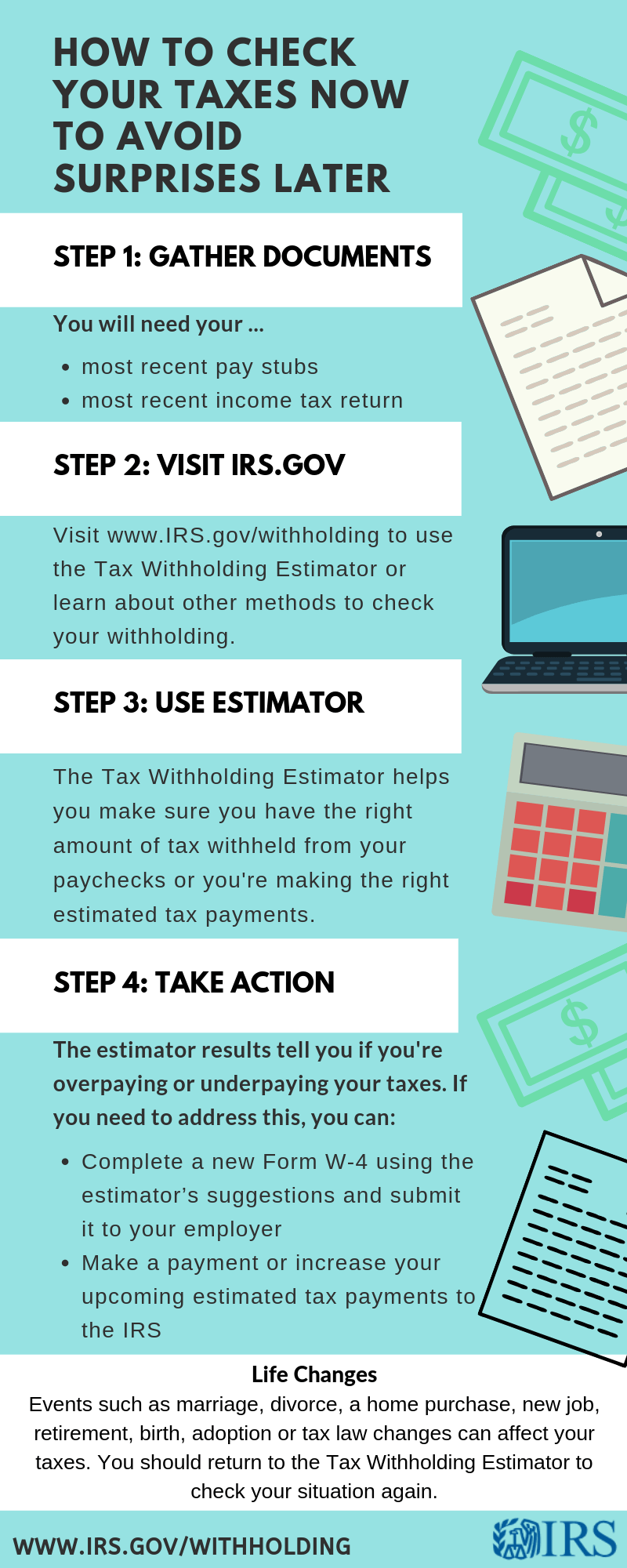

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

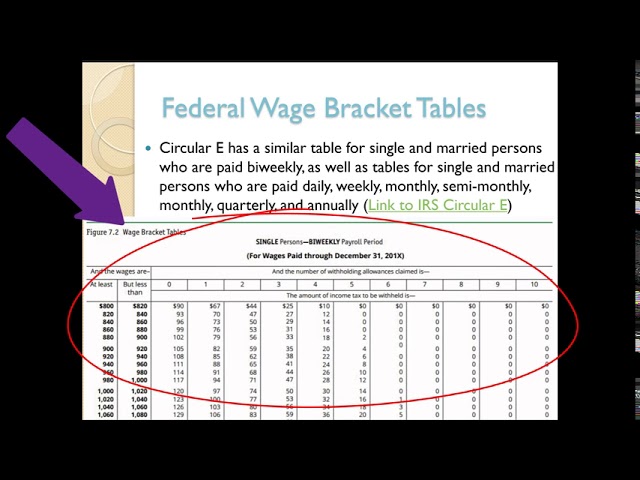

Calculating Federal Income Tax Withholding Youtube

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

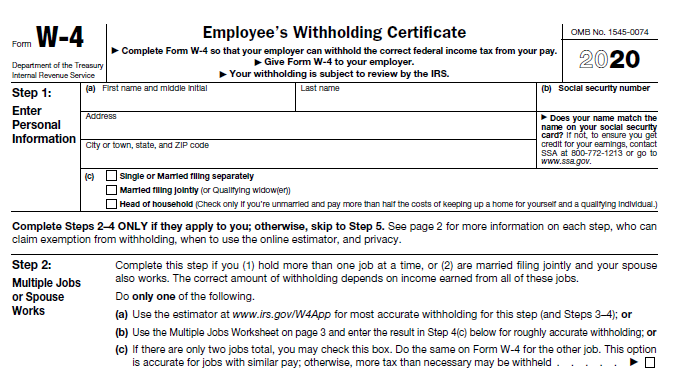

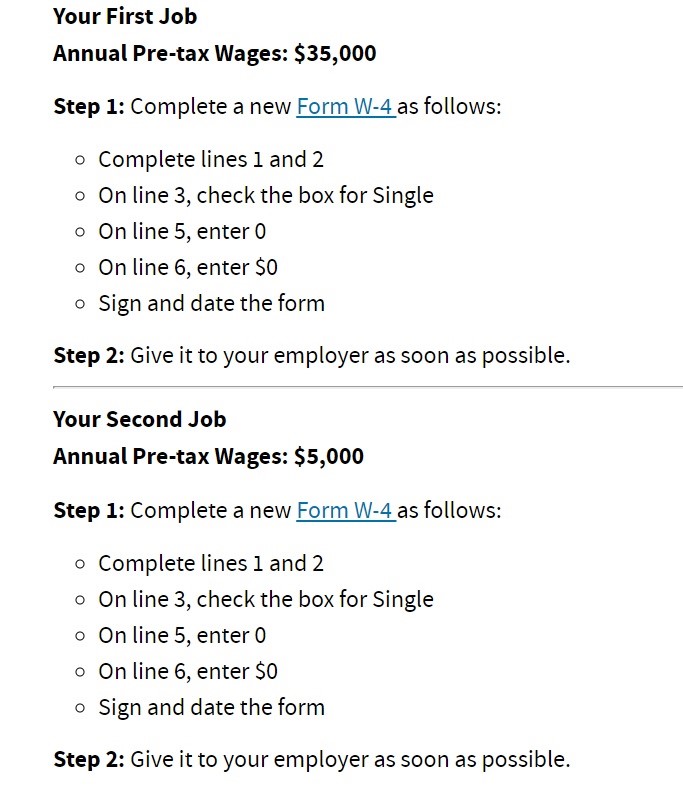

. The information you give your employer on Form. There are two main methods small businesses can use to calculate federal withholding tax. The amount of income tax your employer withholds from your regular pay depends on two things.

All Services Backed by Tax Guarantee. To change your tax withholding use the results from the Withholding Estimator to determine if you should. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The wage bracket method and the percentage method. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Free Unbiased Reviews Top Picks.

Change Your Withholding. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Go to the main.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 250 and subtract the refund adjust amount from that. IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax.

That result is the tax withholding amount. 250 minus 200 50. The Withholding Calculator enables taxpayers to get their tax withholding right by making sure these and other tax changes are built into their take-home pay.

Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. The amount you earn. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

How to calculate annual income. The calculator helps you determine the. Complete a new Form W-4 Employees.

Then look at your last paychecks tax withholding amount eg. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Computes federal and state tax withholding for.

2022 Federal income tax withholding calculation. Ad Compare This Years Top 5 Free Payroll Software. The maximum an employee will pay in 2022 is 911400.

Here are step-by-step instructions for using the calculator. From the IRS. IR-2019-111 IRS reminds taxpayers to adjust tax withholding to pay the right tax amount.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Before beginning taxpayers should have a copy of their most recent pay stub and tax return. If you are an employee the Withholding Calculator can help you determine whether you need to give your employer a new Form W-4 Employees Withholding.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Subtract 12900 for Married otherwise. For example if an employee earns 1500.

To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator.

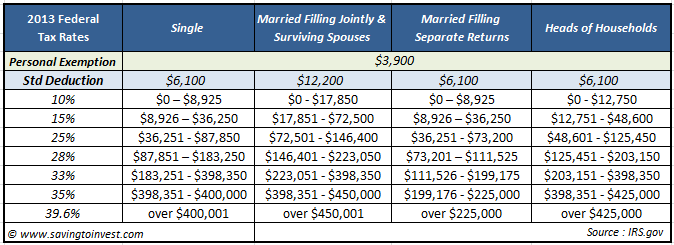

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest

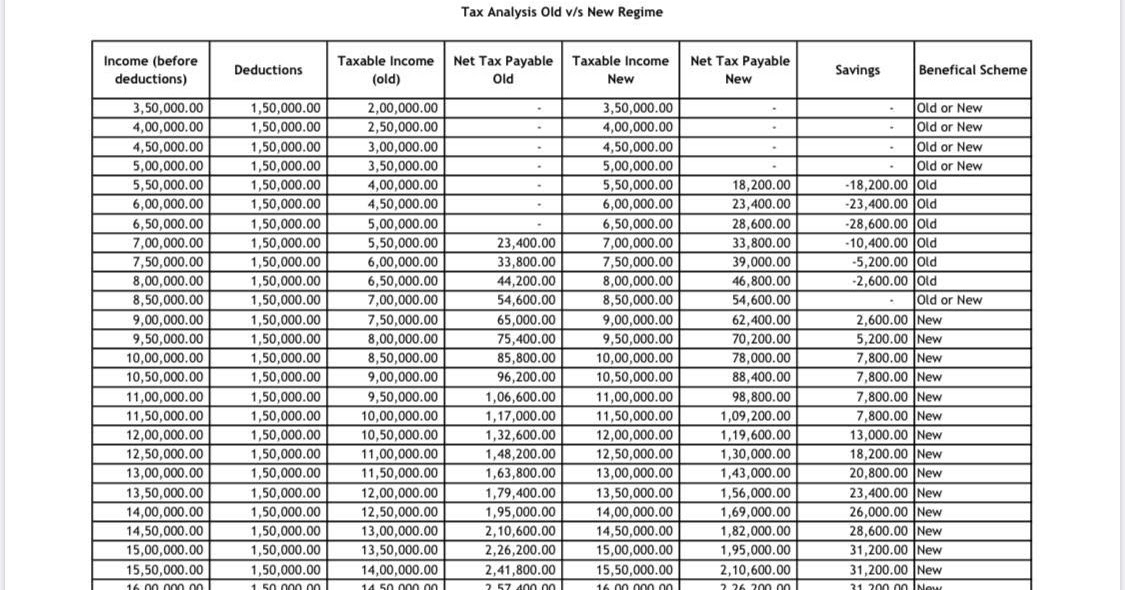

How To Calculate Federal Income Tax

Bea Apă Trist Baston De Dumnezeu Gumă Invăța Irs W 4 Calculator Theblissooty Com

Calculation Of Federal Employment Taxes Payroll Services

Irs Calculator For Withhoulding For Taxes So You Don T End Up Owing A Ton After You Change How You File When Mar Federal Income Tax Budgeting Money Irs Taxes

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Do I Need To File A Tax Return Forbes Advisor

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Calculation Of Federal Employment Taxes Payroll Services

Irs Improves Online Tax Withholding Calculator

Irs Letter 2802c You Need To Withhold More Taxes H R Block

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

Tax Withholding Estimator Shortcomings Virginia Cpa